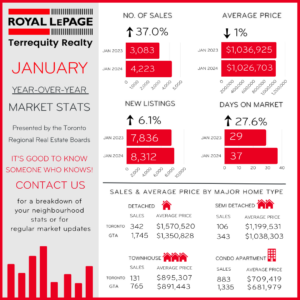

The first month of January 2024 was quite robust with year over year sales increasing by 37% with the average price down slightly by 1%. It’s early days still but there’s a noticeable more positive attitude amongst buyers compared to fall of last year. This is a result of the Bank of Canada indicating rate increases are on hold and anticipation that interest rates will drop as the year progresses. The date they start to drop is unknown but once they do buyers will come roaring back into the market. More buyers will mean higher prices if supply cannot meet the demand. Some buyers are trying to jump start their entry now and beat possible price increases which is why the sudden surge in activity. I think the mild winter is a factor too since people are in the mindset of spring and are willing to get out and start the house search not deterred by cold or snow. Reach out to me if you have questions about the market, I have the data, information and insight to assist you. As always, no pressure or sales tactics, just good solid information.

Royal Lepage Forecasted Activity for 2024 year ahead

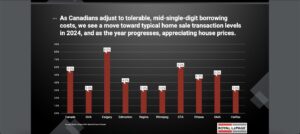

2023 was a roller coaster with plenty of ups and downs. Overall sales volume was the lowest level in the past 20 years with approximately 65,000 units sold. This is a dramatic drop from the last few years that saw record highs. Condo sales were very sluggish, many investors started to unload their rental properties. 2024 feels like a fresh start and has already exceeded expectations. The mild weather combined with a more positive outlook on interest rates has shifted the tune. While it’s still early days it’s excepted to be a much busier and higher volume sales year ahead.

What I do know is that more than ever you must have an experienced Realtor working for you! A Realtor that understands the dynamics of the current market and understands the nuances of your neighbourhood and areas of interest. You need to work with an experienced full time Realtor, one with boots on the ground all day, everyday. One that has strong analytical, negotiation and communication skills. One that provides the right Comparative Market Analysis (CMA) on properties in your area, has strong project management and quality marketing, someone who can help navigate the process.

I’ve been a Realtor for 20 years and have worked in all types of markets. I’ve seen a lot and know a lot and can assist by providing quality insights, strategic thinking and sound knowledge. You should always receive a detailed analysis on whats happening in your neighbourhood and area of interest. If we need deeper information on an area outside of my core base area I will bring in one of my trusted Realtors from that area utilizing my wide range of contacts throughout the GTA and Ontario.

I pride myself in taking very good care of my clients. This is important work and you must have someone you can completely trust with the very best representation with no pressure, only guaranteed reliable professional service.

I would love to speak with you further, please reach out to me and we’ll get the conversation started.

Terri Perras